|

|

|

|||||||||||

| |||||||||||||

|

|

|

|||||||||||

| Background on Minor Metals: A Market Analysis

Download Brochure (includes TOC) |

Minor Metals: A Market Analysis |

||||

|

|

|

Each chapter covering a single metal includes the following sections:

- Background

- Sourcing and Production

- Safety, Health and the Environment

- Applications

- Market Analysis

Background on Minor Metals: A Market Analysis

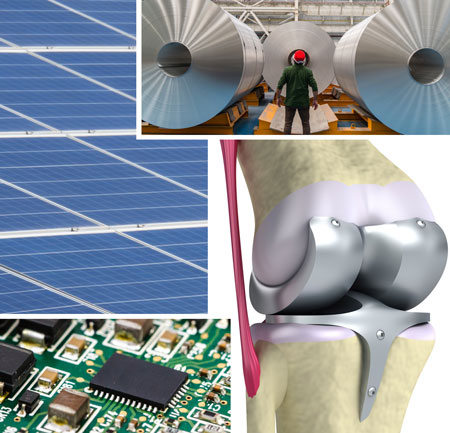

“Minor metals” are anything but. The 25 metals covered in this report, which excludes rare earths, precious metals and platinum group metals, are found in a wide range of industries. Minor metals, many of them irreplaceable in critical applications, in most cases are not sourced directly but only by their presence with other base metal ores with their own distinct markets. This characteristic often separates supply from actual market demand and creates fluctuations in price and availability. Some important minor metals are found in only a few, sometimes politically unstable countries, further contributing to market instability. Toxic metals like mercury and arsenic face dwindling markets as health and environmental regulations make their continued use problematic, while cadmium, also highly toxic, faces even more stringent regulation combined with growing demand in electronics and solar power.

The Thintri market study, Minor Metals: A Market Analysis, provides, for each minor metal included in the report, background information and a study of sourcing and production, as well as discussion of environmental, health, safety and nutrition issues. Each metal is also subjected to an analysis of current applications and market, with forecasts for demand going out to 2024, and price projections based on the influences of relevant markets and the factors affecting those markets.

Understand the Markets

Commodities, in their demand and prices, have had a few difficult years, and this certainly includes minor metals. The picture has improved, and present expert opinion presents a more favorable outlook for the forecast period. The Thintri study, Minor Metals: A Market Analysis, begins with an analysis of the end markets that most affect demand and availability for minor metals in general, such as currency markets, aerospace and defense, semiconductors, electronics, consumer products, automotive and others. The suitability of substitutes for some metals and their likely effects on demand are also discussed for individual metals.

Many minor metals are important constituents of more than one end market, and the report’s market forecasts balance the relative influence of these various factors on overall demand and pricing.

For many of the metals covered in the report, the forecast period represents a time of significant opportunity. For others, the future is bleak. And for a number, life will continue on pretty much as it has in the past. Thintri’s study, Minor Metals: A Market Analysis, provides a basis for the evaluation of opportunities for these metals in investment and trading, their availability and suitability for manufacture and production of numerous products, and a survey of the commercial and industrial landscape affecting these materials.

Order today

#MNM1—Minor Metals: A Market Analysis

Price: $4,300

Report Table of Contents:

CHAPTER 1 MARKET DRIVERS: OVERVIEW 1

1.1 Introduction 1

1.2 Currencies 1

1.3 Steel 1

1.4 Aerospace & Defense 2

1.5 Semiconductors 3

1.6 Consumer Products, Electronics 4

1.7 Automotive 4

1.8 Commodities 6

1.9 Nuclear 7

1.10 A Note About Prices 8

CHAPTER 2 ANTIMONY (Sb) 9

2.1 Background 9

2.2 Sourcing and Production 9

Figure 2-1 Geographic Segmentation, Antimony Production 11

2.3 Safety and Health 11

2.4 Applications 11

Figure 2-2 Antimony Applications by Share 13

2.5 Market Analysis: Antimony 13

Figure 2-3 Antimony Demand Forecast: Metal Hardening, Flame Retardation 14

Figure 2-4 Antimony Demand Forecast: General Industry, Semiconductors, Other 15

Figure 2-5 Total Antimony Demand Forecast 15

Figure 2-6 Antimony Price Projection 16

CHAPTER 3 ARSENIC (As) 17

3.1 Background 17

3.2 Sourcing and Production 17

Figure 3-1 Geographic Segmentation, Arsenic Production 18

3.3 Safety and Health 18

3.4 Applications 18

Figure 3-2 Arsenic Applications by Share 20

3.5 Market Analysis: Arsenic 20

Figure 3-3 Arsenic Demand Forecast: Agriculture and Construction 21

Figure 3-4 Arsenic Demand Forecast: General Industry and Electronics 21

Figure 3-5 Total Arsenic Demand Forecast 22

Figure 3-6 Arsenic Price Projection 22

CHAPTER 4 BERYLLIUM (Be) 23

4.1 Background 23

4.2 Sourcing and Production 23

Figure 4-1 Geographic Segmentation, Beryllium Production 24

4.3 Safety, Health and the Environment 24

4.4 Applications 25

Figure 4-2 Beryllium Applications by Share 28

Figure 4-3 Beryllium Applications by Share, End Markets 28

4.5 Market Analysis: Beryllium 28

Figure 4-4 Beryllium Demand Forecast: Electronic Components, Electronic Substrates 29

Figure 4-5 Beryllium Demand Forecast: Alloying 29

Figure 4-6 Total Beryllium Demand Forecast 30

Figure 4-7 Beryllium Price Projection 30

CHAPTER 5 BISMUTH (Bi) 31

5.1 Background 31

5.2 Sourcing and Production 31

Figure 5-1 Geographic Segmentation, Bismuth Production 32

5.3 Safety and Health 32

5.4 Applications 32

Figure 5-2 Bismuth Applications by Share 33

5.5 Market Analysis: Bismuth 33

Figure 5-3 Bismuth Demand Forecast: Alloys, Pharmaceuticals and Chemicals 35

Figure 5-4 Bismuth Demand Forecast: Metal Additives and Other 35

Figure 5-5 Total Bismuth Demand Forecast 36

Figure 5-6 Bismuth Price Projection 36

CHAPTER 6 CADMIUM (Cd) 37

6.1 Background 37

6.2 Sourcing and Production 37

Figure 6-1 Geographic Segmentation, Cadmium Production 38

6.3 Health, Safety and the Environment 38

6.4 Applications 40

6.4.1 Coatings 40

6.4.2 Pigments 42

6.4.3 Batteries 43

6.4.4 Alloying 45

6.4.5 Electronics and Semiconductors 47

6.4.6 Other Applications 47

Figure 6-2 Cadmium Applications by Share 49

6.5 Market Analysis: Cadmium 49

Figure 6-3 Cadmium Demand Forecast: Batteries and Coatings 51

Figure 6-4 Cadmium Demand Forecast: Pigments and Plastic Stabilizers 51

Figure 6-5 Total Cadmium Demand Forecast 52

Figure 6-6 Cadmium Price Projection 52

CHAPTER 7 CHROMIUM (Cr) 53

7.1 Background 53

7.2 Sourcing and Production 53

Figure 7-1 Geographic Segmentation, Chromium Production 54

7.3 Safety, Health and the Environment 54

7.4 Applications 55

Figure 7-2 Chromium Applications by Share 56

7.5 Market Analysis: Chromium 56

Figure 7-3 Chromium Demand Forecast: Alloying and Plating 57

Figure 7-4 Chromium Demand Forecast, Chemical Processing and Other 57

Figure 7-5 Total Chromium Demand Forecast 58

Figure 7-6 Chromium Price Projection: Ingot 58

CHAPTER 8 COBALT (Co) 59

8.1 Background 59

8.2 Sourcing and Production 60

Figure 8-1 Geographic Segmentation: Cobalt Production 61

8.3 Health, Safety and Nutrition 61

8.4 Applications 62

Figure 8-2 Cobalt Applications by Share 63

8.5 Market Analysis: Cobalt 63

Figure 8-3 Cobalt Demand Forecast: Batteries, Alloying and Tools 64

Figure 8-4 Cobalt Demand Forecast: Catalysts, Pigments and Magnets 65

Figure 8-5 Cobalt Demand Forecast: Soaps and Other 65

Figure 8-6 Total Cobalt Demand Forecast 66

Figure 8-7 Cobalt Price Projection 66

CHAPTER 9 GALLIUM (Ga) 67

9.1 Background 67

9.2 Sourcing and Production 67

Figure 9-1 Geographic Segmentation, Gallium Production 68

9.3 Health, Safety and the Environment 68

9.4 Applications 69

9.4.1 Industry 69

9.4.2 Semiconductors 69

Figure 9-2 Gallium Applications by Share 72

9.5 Market Analysis: Gallium 72

Figure 9-3 Gallium Demand Forecast: Integrated Circuits, Photonics, Alloying & Other 73

Figure 9-4 Total Gallium Demand Forecast 74

Figure 9-5 Gallium Price Projection 74

CHAPTER 10 GERMANIUM (Ge) 75

10.1 Background 75

10.2 Sourcing and Production 75

Figure 10-1 Geographic Segmentation, Germanium Production 75

10.3 Safety and Health 75

10.4 Applications 76

Figure 10-2 Germanium Applications by Share 77

10.5 Market Analysis: Germanium 77

Figure 10-3 Germanium Demand Forecast: Fiber Optics, IR Optics, Electronics/Solar 78

Figure 10-4 Germanium Demand Forecast: Polymer Catalysts, Other 78

Figure 10-5 Total Germanium Demand Forecast 79

Figure 10-6 Germanium Price Projection 79

CHAPTER 11 HAFNIUM (Hf) 80

11.1 Background 80

11.2 Sourcing and Production 80

Figure 11-1 Geographic Segmentation, Hafnium Production 81

11.3 Safety and Health 82

11.4 Applications 82

11.4.1 Nuclear 82

11.4.2 Alloying 82

11.4.3 Other applications 83

Figure 11-2 Hafnium Applications by Share 84

11.5 Market Analysis: Hafnium 84

Figure 11-3 Hafnium Demand Forecast: Superalloys – Aerospace and Non-Aerospace 85

Figure 11-4 Hafnium Demand Forecast: Nuclear, Hf Oxide 86

Figure 11-5 Hafnium Demand Forecast: Plasma Tools, Chemical Processing, Thin Films 86

Figure 11-6 Total Hafnium Demand Forecast 87

Figure 11-7 Hafnium Price Projection 87

CHAPTER 12 INDIUM (In) 88

12.1 Background 88

12.2 Sourcing and Production 88

Figure 12-1 Geographic Segmentation, Indium Production 89

12.3 Safety and Health 89

12.4 Applications 89

Figure 12-2 Indium Applications by Share 91

12.5 Market Analysis: Indium 91

Figure 12-3 Indium Demand Forecast: Coatings 93

Figure 12-4 Indium Demand Forecast: Alloys and Plating 93

Figure 12-5 Indium Demand Forecast: Semiconductors and Electrical Components 94

Figure 12-6 Total Indium Demand Forecast 94

Figure 12-7 Indium Price Projection 95

CHAPTER 13 LITHIUM (Li) 96

13.1 Background 96

13.2 Sourcing and Production 96

Figure 13-1 Geographic Segmentation, Lithium Production 97

13.3 Health and Safety: Metallic Lithium 98

13.4 Applications 98

13.4.1 General Industry 98

13.4.2 Batteries and Power Storage 99

13.4.3 Medicine 100

Figure 13-2 Lithium Applications by Share 101

13.5 Market Analysis: Lithium 101

Figure 13-3 Lithium Batteries, Cost per Kilowatt-Hour 102

Figure 13-4 Lithium Demand Forecast: Ceramics & Glass, Batteries 103

Figure 13-5 Lithium Demand Forecast: Lubricants, Medical, Other 103

Figure 13-6 Total Lithium Demand Forecast 104

Figure 13-7 Lithium Price Projection: Ingot 104

CHAPTER 14 MAGNESIUM (Mg) 105

14.1 Background 105

14.2 Sourcing and Production 106

Figure 14-1 Geographic Segmentation, Magnesium Production 106

14.3 Health, Safety & Nutrition 106

14.4 Applications 107

Figure 14-2 Magnesium Applications by Share 109

14.5 Market Analysis: Magnesium 109

Figure 14-3 Magnesium Demand Forecast: Alloying Aluminum, Die Casting 110

Figure 14-4 Magnesium Demand Forecast: Other Metallurgical, Other 111

Figure 14-5 Total Magnesium Demand Forecast 111

Figure 14-6 Magnesium Price Projection: Ingot 112

CHAPTER 15 MANGANESE (Mn) 113

15.1 Background 113

15.2 Sourcing and Production 113

Figure 15-1 Geographic Segmentation, Manganese Production 114

15.3 Health, Nutrition and Safety 114

15.4 Applications 115

Figure 15-2 Manganese Applications by Share 117

15.5 Market Analysis: Manganese 117

Figure 15-3 Manganese Demand Forecast: Alloying Steel 118

Figure 15-4 Manganese Demand Forecast: Alloying Aluminum, Alloying Other, Other Applications 118

Figure 15-5 Total Manganese Demand Forecast 119

Figure 15-6 Manganese Price Projection 119

CHAPTER 16 MERCURY (Hg) 120

16.1 Background 120

16.2 Sourcing and Production 120

Figure 16-1 Geographic Segmentation, Mercury Production 121

16.3 Health, Safety and the Environment 121

16.4 Applications 122

Figure 16-2 Mercury Applications by Share 123

16.5 Market Analysis: Mercury 123

Figure 16-3 Mercury Demand Forecast: Catalysts, Electrical Components 124

Figure 16-4 Total Mercury Demand Forecast 124

Figure 16-5 Mercury Demand Forecast: Mining, Other 125

Figure 16-6 Mercury Price Projection 125

CHAPTER 17 MOLYBDENUM (Mo) 126

17.1 Background 126

17.2 Sourcing and Production 126

Figure 17-1 Geographic Segmentation, Molybdenum Production 127

17.3 Health, Safety and Nutrition 127

17.4 Applications 128

Figure 17-2 Molybdenum Applications by Share 130

17.5 Market Analysis: Molybdenum 130

Figure 17-3 Molybdenum Demand Forecast: Alloying 131

Figure 17-4 Molybdenum Demand Forecast: Chemicals, Catalysts and Pigments 131

Figure 17-5 Molybdenum Demand Forecast: Lubricants and Pure Metal 132

Figure 17-6 Total Molybdenum Demand Forecast 132

Figure 17-7 Molybdenum Price Projection 133

CHAPTER 18 NIOBIUM (Nb) 134

18.1 Background 134

18.2 Sourcing and Production 134

Figure 18-1 Geographic Segmentation, Niobium Production 135

18.3 Health and Safety 135

18.4 Applications 136

Figure 18-2 Niobium Applications by Share 138

18.5 Market Analysis: Niobium 138

Figure 18-3 Niobium Demand Forecast: Steels and Superalloys 139

Figure 18-4 Niobium Demand Forecast: Optics and Electronics 139

Figure 18-5 Niobium Demand Forecast: Industrial and Other 140

Figure 18-6 Total Niobium Demand Forecast 140

Figure 18-7 Niobium Price Projection 141

CHAPTER 19 SELENIUM (Se) 142

19.1 Background 142

19.2 Sourcing and Production 142

Figure 19-1 Geographic Segmentation, Selenium Production 143

19.3 Health, Safety and Nutrition 143

19.4 Applications 144

Figure 19-2 Selenium Applications by Share 146

19.5 Market Analysis: Selenium 146

Figure 19-3 Selenium Demand Forecast: Alloying and Glass Making 147

Figure 19-4 Selenium Demand Forecast: Agriculture and Chemicals 147

Figure 19-5 Selenium Demand Forecast: Pigments, Electronics and Other 148

Figure 19-6 Total Selenium Demand Forecast 148

Figure 19-7 Selenium Price Projection, Ingot 149

CHAPTER 20 SILICON (Si) 150

20.1 Background 150

20.2 Sourcing and Production 151

Figure 20-1 Geographic Segmentation, Silicon Production 151

20.3 Safety, Health and Nutrition 152

20.4 Applications 152

Figure 20-2 Silicon Applications by Share 154

20.5 Market Analysis: Silicon 154

Figure 20-3 Silicon Demand Forecast: Alloying, Silicones 155

Figure 20-4 Silicon Demand Forecast: Electronics and Industrial 155

Figure 20-5 Total Silicon Demand Forecast 156

Figure 20-6 Silicon Price Projection 156

CHAPTER 21 TANTALUM (Ta) 157

21.1 Background 157

21.2 Sourcing and Production 157

Figure 21-1 Geographic Segmentation, Tantalum Production 158

21.3 Health and Safety 158

21.4 Applications 158

Figure 21-2 Tantalum Applications by Share 160

21.5 Market Analysis: Tantalum 160

Figure 21-3 Tantalum Demand Forecast: Electronics and Alloying 161

Figure 21-4 Tantalum Demand Forecast: Industrial and Medical 162

Figure 21-5 Total Tantalum Demand Forecast 162

Figure 21-6 Tantalum Price Projection 163

CHAPTER 22 TELLURIUM (Te) 164

22.1 Background 164

22.2 Sourcing and Production 164

Figure 22-1 Geographic Segmentation: Tellurium Production 165

22.3 Safety and Health 165

22.4 Applications 166

Figure 22-2 Tellurium Applications by Share 167

22.5 Market Analysis: Tellurium 167

Figure 22-3 Tellurium Demand Forecast: Steels and Other Alloying 168

Figure 22-4 Tellurium Demand Forecast: Industrial and Rubber 168

Figure 22-5 Tellurium Demand Forecast: Solar Panels and Electronics 169

Figure 22-6 Total Tellurium Demand Foreacast 169

Figure 22-7 Tellurium Price Projection: Ingot 170

CHAPTER 23 TITANIUM (Ti) 171

23.1 Background 171

23.2 Sourcing and Production 171

Figure 23-1 Geographic Segmentation, Titanium Production 173

23.3 Safety and Health 173

23.4 Applications 174

23.4.1 Chemicals 174

23.4.2 Pigments 174

Figure 23-2 Titanium: Metallic vs. Oxide 175

23.4.3 Industry and Aerospace 176

23.4.4 Medicine 177

23.4.5 Consumer Products 177

Figure 23-3 Metallic Titanium Applications by Share 178

23.5 Market Analysis: Titanium 178

Figure 23-4 Titanium Demand Forecast: Industrial and Aerospace 179

Figure 23-5 Titanium Demand Forecast: Defense and Medical 179

Figure 23-6 Titanium Demand Forecast: Consumer and Automotive 180

Figure 23-7 Total Titanium Demand Forecast 180

Figure 23-8 Titanium Price Projection 181

CHAPTER 24 TUNGSTEN (W) 182

24.1 Background 182

24.2 Sourcing and Production 182

Figure 24-1 Geographic Segmentation, Tungsten Production 183

24.3 Safety and Health 183

24.4 Applications 183

24.4.1 Metallic Tungsten 183

24.4.2 Chemical Tungsten 184

24.4.3 Tungsten Carbide and Alloys 184

Figure 24-2 Tungsten Applications by Share 186

24.5 Market Analysis: Tungsten 186

Figure 24-3 Tungsten Demand Forecast: Hard Metals and Alloys 187

Figure 24-4 Tungsten Demand Forecast: Chemicals and Other 187

Figure 24-5 Total Tungsten Demand Forecast 188

Figure 24-6 Tungsten Price Projection 188

CHAPTER 25 VANADIUM (V) 189

25.1 Background 189

25.2 Sourcing and Production 189

Figure 25-1 Geographic Segmentation: Vanadium Production 190

25.3 Safety and Health 190

25.4 Applications 191

Figure 25-2 Vanadium Applications by Share 193

25.5 Market Analysis: Vanadium 193

Figure 25-3 Vanadium Demand Forecast: Steel Alloys and Titanium Alloys 194

Figure 25-4 Vanadium Demand Forecast: Chemicals and Other 194

Figure 25-5 Total Vanadium Demand Forecast 195

Figure 25-6 Vanadium Price Projection 195

CHAPTER 26 ZIRCONIUM (Zr) 196

26.1 Background 196

26.2 Sourcing and Production 196

Figure 26-1 Geographic Segmentation, Zirconium Production 197

26.3 Safety and Health 197

26.4 Applications 198

Figure 26-2 Zirconium Applications by Share 200

26.5 Market Analysis: Zirconium 200

Figure 26-3 Zirconium Demand Forecast: Nuclear 201

Figure 26-4 Zirconium Demand Forecast: Alloys, Industrial and Other 201

Figure 26-5 Total Zirconium Demand Forecast 202

Figure 26-6 Zirconium Price Projection 202

Order today

#MNM1 Minor Metals: A Market Analysis

$4,300

About Thintri || Recent Projects || Contact Us || Order Report || Market Reports || Privacy Statement

© Copyright, 2018, Thintri, Inc. All rights reserved.

Phone: (914) 242-4615 • Fax: (914) 666-4114

To report problems with this site, please contact the webmaster.